“Bitcoin is life.

Bitcoin is hope.

Bitcoin is money for a better world.

It’s money for the people.

Bitcoin is freedom money.”

― Matthew Kratter, Bitcoin Influencer & Investor

The Wolves Within is a must-read for every believer who refuses to be deceived.

Hit the Tip Jar and help spread the message!

This post contains affiliate links, which means I may receive a commission or affiliate fee for purchases made through these links.

Unlock the mysteries of Biblical cosmology and enrich your faith with some of the top rated Christian reads at BooksOnline.club.

Click the image below and be sure to use promo code SCIPIO for 10% off your order at HeavensHarvest.com: your one stop shop for emergency food, heirloom seeds and survival supplies.

Related Entries

In an era defined by rapid technological transformation and an ever-encroaching surveillance state, Bitcoin has been lauded as the panacea for our (admittedly) antiquated, debt-based, fiat monetary system. However, a growing body of evidence and analysis suggests that beneath the veneer of libertarian utopianism, Bitcoin serves a very different purpose.

At its inception in 2008, Bitcoin was conceived of as a “peer-to-peer electronic cash system” — a radical departure from the centralized paradigms that had defined monetary policy for the previous two centuries. The genius of Bitcoin lies in its novel amalgamation of cryptographic hashing and digital signatures. Hash functions, by design, transmute any input data into a fixed-length, ostensibly unique string: a digital fingerprint that is near-impossible to replicate. As such, digital signatures furnish a mechanism for the verification of transactional authenticity. The integrity of Bitcoin’s blockchain — the indelible, distributed ledger that records every transaction — is inextricably bound to the hash function known as SHA-256.

Herein lies an early portent of the platform’s double-edged nature: SHA-256 was a creation of the National Security Agency (NSA):

The integrity of Bitcoin’s blockchain and consensus over the ordering of transactions depend on a hash function called SHA-256, which was designed by the NSA and published by the National Institute for Standards and Technology (NIST).

Cryptography researcher Matthew D. Green of Johns Hopkins University said, “If you assume that the NSA did something to SHA-256, which no outside researcher has detected, what you get is the ability, with credible and detectable action, they would be able to forge transactions. The really scary thing is somebody finds a way to find collisions in SHA-256 really fast without brute-forcing it or using lots of hardware and then they take control of the network.”

Thus, while the ostensible brilliance of Bitcoin’s decentralized ledger seduces libertarians and technophiles alike, its reliance on an NSA-engineered technology — at the very least — opens up the possibility of a purposely engineered backdoor in its core cryptographic functions. Truly, it strains credulity to believe that the masters of digital lockpicking would release a lock to the world they don’t have the key to. Regardless of Bitcoin's origins or its tangential ties to the NSA, the transparency of Bitcoin’s blockchain ledger serves as a veritable panopticon.

Every transaction forms a detailed tapestry of economic activity, readily exploitable by those possessing the requisite analytic and technical resources — like say, state security and intelligence agencies.

— Bust in honor of “Satoshi Nakamoto” in Budapest, Hungary.

Moreover, the still elusive figure of Bitcoin’s inventor, Satoshi Nakamoto, intensifies the currents of suspicion. There is little controversy over the interpretation of Satoshi as meaning “intelligence.” However, his surname, Nakamoto, is more opaque; some have suggested it may mean “central origin.” Though a definitive interpretation is hampered by the absence of the kanji, this alternative reading intimates that Bitcoin’s genesis might be less a spontaneous act of anarchistic rebellion than a calculated maneuver to lay the intellectual groundwork for an all-encompassing system of control.

It is also incumbent upon us to distinguish Bitcoin from the broader phenomenon of blockchain technology. Whereas Bitcoin represents one specific instantiation of this technology — digital currency — blockchain itself is applicable to a myriad of domains, including logistics, identity verification, and “smart contracts.” The gradual normalization of blockchain constitutes a subtle indoctrination into a not-so distant future where every transaction, every datum, is permanently recorded and accessible. In this light, Bitcoin is not an isolated experiment but rather the herald of an all-encompassing digital order wherein surveillance is embedded in the very infrastructure of our economic and social lives.

Thus, what at first blush appears to be a revolutionary system of decentralized finance presages a future in which the state wields unprecedented power over the minutiae of individual economic conduct.

“Blockchain technology is a powerful but underutilized forensic tool for governments to identify illicit activity and bring criminals to justice.”

— Michael Morell, Acting CIA Director. An Analysis of Bitcoin’s Use in Illicit Finance, April 6th, 2021

The mythos of Bitcoin as an impervious, tamper-proof sanctuary of financial autonomy is a narrative ardently propagated by its supporters. Yet, a more circumspect analysis reveals that the very features extolled as enablers of freedom may also constitute its Achilles’ heel. Beneath the veneer of anonymity lies a system of considerable vulnerability — one whose cryptographic fortifications are not immune to exploitation, and whose ostensibly immutable ledger is a veritable treasure trove for state actors.

The history of Bitcoin makes it clear that its technical underpinnings are not static; they are steered by a cadre of “core developers”:

[We] typically hear that “crypto is different” because it’s decentralized, but in fact, it’s not decentralized. At every level, there are people controlling things.

We heard that Bitcoin is decentralized. Well, Bitcoin is controlled by a few core software developers—fewer than ten—and they can make changes to the software, and then that software is implemented by mining pools, and there are just a few of them. So in all of these spaces, there are definitely people—often very few people—pulling the strings.

— Professor Hilary Allen, December 14th, 2022

Although the decentralized mythos suggests that no single entity may commandeer the network, history reveals that a select group of influential programmers retains the power to effectuate pivotal modifications to the blockchain. While the twenty-one million cap on Bitcoin is oft lauded as a hedge on potential inflationary pressures, it remains theoretically possible to increase that limit — a proposition that has increasingly been discussed in recent years. This malleability, while a testament to the system’s adaptability, also renders it amenable to future subversion, like in the case of a 51% attack.

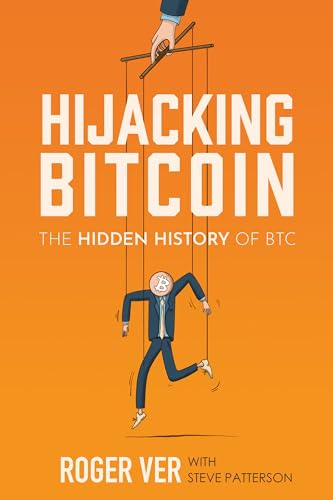

The transparent nature of blockchain technology reveals itself as a potent forensic instrument in the hands of government agencies. With sophisticated analytical algorithms at their disposal (courtesy of our tax dollars), intelligence agencies have already dissected the public ledger, correlating disparate transactions to construct detailed profiles of individual behavior. As Roger Ver astutely noted (emphasis mine):

Confiscation has already become easy due to the trend towards custodial wallets. It happens all the time. Because the blockchain is public, governments can mark particular coins as suspicious and track them throughout the ledger. If the coins arrive at a centralized cryptocurrency exchange, as they usually do, the exchanges will freeze the corresponding accounts and notify the authorities. The coins in question can then be seized with a few clicks. Even if the coins do not move to a centralized exchange, they have likely moved from one, which—due to compliance with knowyour-customer laws—gives the government the identity of at least one person who has touched those coins. From that point, they can surveil the blockchain to track the economic activity of that individual and work out plausible identities for anybody they have transacted with. This already happens when Bitcoin is involved with large criminal cases, but there is no fundamental reason why it couldn’t happen to everyday users.

— Hijacking Bitcoin: The Hidden History of BTC

This capacity for rapid, algorithm-driven confiscation is not merely a hypothetical menace — it is a present and palpable reality. One need look no further than the outbreak of the Ukraine War: Bitcoin was immediately banned by Russian authorities and digital wallets were severely restricted in Ukraine, both of which have launched Central Bank Digital Currencies (CBDCs). Once digital assets transition from personal custody to centralized repositories, they are inexorably linked to the identity of their owner, rendering them susceptible to a panoply of state-sanctioned interventions.

The inherent susceptibilities of blockchain technology are further underscored by historical precedents in the cryptocurrency ecosystem. Consider the case of Ethereum:

…one morning in September 2016, nearly a third of the funds, amassing to around $60 million worth of Ether, was drained by hackers using a code exploit. Even after “a white-hat counterattack,” the hacked funds would “ultimately amount to around 5% of all the Ethereum tokens in existence at the time.” This led the Ethereum Foundation to a difficult decision: honor the concept of “code as law” and allow the hackers to keep the funds, or break the immutability of the blockchain and “roll back” the transactions to return the funds. The Ethereum Foundation decided to take the latter path and return the funds to the DAO, and thus the perceived nature of Ethereum’s immutability [sic] and decentralized nature was called into question.

The Ethereum Foundation’s decision to restore the stolen funds further accentuates the fragility of decentralized idealism in the face of financial realities.

In tandem with these technical vulnerabilities looms the ever present specter of direct surveillance:

Classified documents provided by whistleblower Edward Snowden show that the National Security Agency indeed worked urgently to target bitcoin users around the world — and wielded at least one mysterious source of information to “help track down senders and receivers of Bitcoins,” according to a top-secret passage in an internal NSA report dating to March 2013. The data source appears to have leveraged the NSA’s ability to harvest and analyze raw, global internet traffic while also exploiting an unnamed software program that purported to offer anonymity to users, according to other documents.

— The NSA Worked to “Track Down” Bitcoin Users, Snowden Documents Reveal

This only underscores the latent peril inherent in electronic financial systems that — while ostensibly decentralized and aimed at undermining state control — are ripe for exploitation by the state. The intrinsic interplay between the surveillance state and the forensic capabilities of blockchain technology exposes a disquieting reality: far from being an unfettered bastion of freedom, digital currency is fraught with mechanisms of both surveillance and control.

The case of Nikolai Mushegian stands as a chilling example of the forces that lurk behind the so-called revolution of digital finance (emphasis mine):

On October 24, the MakerDAO, “the largest single holder of USDC,” [USD Coin] approved a community proposal to custody nearly $1.6 billion USDC with Coinbase Prime. Four days later, Nikolai Mushegian, the co-founder of “the largest decentralized finance protocol” MakerDAO, the architect of DAI, a contributor to Larimer’s BitShares, and inventor of the DAI-fork stablecoin Rai, tweeted that his life was in danger due to a Caribbean island blackmail ring, supposedly backed by Israeli and U.S. intelligence agents. At the time of this tweet, he was “working on a crypto project called Rico,” a “free-floating decentralized stablecoin system” aiming to be the “spiritual successor of DAI” and designed “without compromises.” Three days later, on Halloween, the 29-year-old coder Mushegian was found dead, having drowned in the sea off Condado Beach in Puerto Rico. He was “wearing his clothes and had his wallet on him,” sources told The New York Post.

The claims of Bitcoin billionaire pedophile rings in Puerto Rico have been substantiated by others, but Mushegian’s mysterious and untimely death is emblematic of a broader truth: true decentralization is antithetical to the interests of the financial and intelligence apparati.

Thus, the myth of Bitcoin’s invulnerability or immutability is not merely an artifact of ideological fervor or slick salesmanship: it is a dangerous illusion that obfuscates a host of systemic architectural vulnerabilities.

— Amongst the last tweets of Nikolai Mushegian.

“Those who say that bitcoin is a threat to the dollar have it exactly backwards, the danger to our financial future comes from Washington D.C., not crypto."

— President Donald J. Trump, July 28th, 2024

The convergence of state power and digital currency has reached a critical juncture — a juncture marked by the overt politicization of cryptocurrency by the Trump administration’s blitz into digital currency reform. As the moneyed interests and Silicon Valley conglomerates coalesce around digital currency, the promise of decentralization has all but eroded, supplanted by an ever-tightening web of surveillance and financial oversight. What was once heralded as a revolutionary departure from the tyranny of centralized banks is being recast as a modern adaptation of fiscal policy — albeit one that is inextricably interwoven with state interests and corporate oligarchies.

The Trump administration’s fervor for digital currency reform is not an isolated phenomenon: it is emblematic of a broader institutional embrace of cryptocurrencies and blockchain technology. Ben Bernanke, alongside magnates such as John Mack — the erstwhile CEO of Morgan Stanley who candidly admitted his longstanding investments in digital currencies — epitomize the transformation of traditional money managers into ardent proponents of the new fiscal order. (And in a move as predictable as it is cynical, Trump has followed his Noahide protégé Javier Milei into the crypto grift, launching his own digital token while Milei’s "free market" experiment collapses in a $107 million insider heist.)

Looking back, it becomes clear that the inexorable march toward a state-sanctioned digital currency was only further accelerated by the emergence of Bitcoin. In such a milieu, the ostensible advantages of a decentralized system are rendered moot, as governments harness blockchain’s forensic transparency to impose a panopticon over every transaction. The integration of custodial wallets and regulatory protocols ensure that every digital transaction is indelibly linked to your driver’s license — a linkage that can be exploited to track, control, and, if necessary, confiscate your digital assets with alarming ease.

— BTC, digital art, 2025.

It is no accident that many of the leading tech CEO’s in America had better seats to the second Trump inauguration than the man’s own cabinet. In this relentless tide of digital transformation, the lofty ideals of decentralization are being subverted by a new synthesis of state and corporate power — a meticulously regulated order in which every transaction is subject to omnipresent scrutiny. As Mussolini articulated in On The Corporate State:

The Corporation operates in the economic field as the Grand Council and the Militia operate in the political field.

Corporations mean regulated economy and therefore also controlled economy, for there can be no regulation without control.

Corporations supersede socialism and supersede liberalism, they establish a new synthesis.

In our contemporary political landscape, such doctrines have an uncomfortable relevance. The instruments once celebrated as emblems of emancipation — blockchain’s immutable ledger, sophisticated cryptographic safeguards, and decentralized consensus — are now being repurposed or exploited to form the backbone of an all-encompassing financial surveillance regime. Rather than catalyzing genuine economic liberation, digital currencies are steering us toward a dystopian reality in which every digital footprint is meticulously catalogued and any deviation from state-sanctioned norms will be swiftly neutralized.

The seductive promise of a decentralized monetary utopia is revealed, upon closer inspection, to be but an opiate — a veneer that masks the inexorable descent into a new era of digital fascism. In this evolving dystopia, the state’s omnipresent gaze, empowered by the very technologies once believed to emancipate us, will ultimately ensnare every facet of our economic existence. The time has come to recognize that the revolution promised by Bitcoin was never about liberation at all, but rather the calculated establishment of a surveillance apparatus that leaves us no more free than under the old regimes — only now, our chains are forged in ones and zeros.

“After PayPal I never thought I would get interested in payments again. But bitcoin is fulfilling PayPal's original vision to create ‘the new world currency.”

— David O. Sacks, Trump’s AI & Crypto Czar

The Wolves Within is a must-read for every believer who refuses to be deceived.

Hit the Tip Jar and help spread the message!

This post contains affiliate links, which means I may receive a commission or affiliate fee for purchases made through these links.

Unlock the mysteries of Biblical cosmology and enrich your faith with some of the top rated Christian reads at BooksOnline.club.

Click the image below and be sure to use promo code SCIPIO for 10% off your order at HeavensHarvest.com: your one stop shop for emergency food, heirloom seeds and survival supplies.

“What could go wrong with a "currency" created out of thin air by using gigawatts of electricity to run computer calculations and get rewarded by something called a bitcoin???” 1

Even worse than fiat money, Bitcoin is just another mason pump&dump Ponzi scheme, developed by the NSA to allow intel agencies to launder millions and for the elite to evade taxes.

They will kill it with a backdoor or a 51% attack, causing the Great Crush or along the engineered Crush, to enforce the digitatorship through cash-banning Central Bank Digital Currencies tied to government wallets (instatax, Vax/PCR status, monthly carbon quota, Agenda 2030 compliance).

Paper money is also backed by thin air… but not that thin: at least it is pumped by governments, powerful enough to enslave their people with even more taxes to pay for their scam. The essence of unbacked fiat currency is the people’s trust that the debtor (government) will eventually pay, without realizing that they are de debtors themselves!

By the way, the different US Governments never wrote that people should trust them to back the bills… just “In God we trust”… like saying “we don’t even trust ourselves, don’t put your trust in your government.”

Genesis block

1997. Mason IMF- Bank of International Settlements issues a white paper called “How to make a digital bank”.

2008. An anonymous white paper, based on the latter but adding a solution for double-spending, was released: “Bitcoin: A Peer-to-Peer Electronic Cash System”, published by an individual or group using the pseudonym Satoshi Nakamoto.

3 Jan 2009. The first Bitcoin block, known as the Genesis Block or Block 0, was mined by Nakamoto. This event marks the beginning of the Bitcoin blockchain and the cryptocurrency movement.

6 Apr 2021. Acting CIA Director: “Blockchain technology is a powerful but underutilized forensic tool for governments to identify illicit activity and bring criminals to justice.”1 How is it possible that the CIA can trace SHA-256 encrypted transactions supposedly being unbreakable cryptography?

8 Jan 2023. "Satoshi Wallet" or "Genesis Wallet" still held over 1 million Bitcoins, worth $50 BILLION USD. Yet “there used to be 1,000's of high-value +50BTC addresses that were pristine that led back to Satoshi pre-mining era, that also included the public-key ( pre 2014 ), just a few months ago there were over 900, now less than 900. I follow this closely, because my hobby is to hack bitcoin public keys using elliptic-curve pairing&endomorphisms ( See Silverman , elliptic curve arithmetic), I think in 1-2 years all the original Satoshi pristine addresses will be depleted.” 2 Note: those pre-mined Bitcoins were not depleted, most of the original is still there!

9 Jan 2023. Someone sent Satoshi's Genesis Wallet $1.2 million in BTC. Why?

Simple explanation:

Masons founded and still control the CIA, FBI and all intel agencies like the NSA, which was funded in 1952, under mason President Harry Truman.

You need a very unique combination of skills to create Bitcoin: cryptography, programming and social engineering. Most probably Bicoin comes from the belly of the intel beast, almost certainly, the NSA:

• “Truly, it strains credulity to believe that the masters of digital lockpicking would release a lock to the world they don’t have the key to.” 3

• “SHA-256, and SECP256K1 were developed by the NSA, which means they have the backdoors 'keys'” 4 or that they have an algorithm that can decrypt the SHA-256 and a way to detect if someone else develops and uses it, too.

• “they will never release an un-crackable coin, because they need back-doors The SHA-256 (hash) and key sec256p-k1 escdsa is full of backdoors; All NSA algos ever released have back-doors.” 5

If it was just a lonely NSA employee, he would have spent at least part of the $ 50 billions of the genesis block. How can someone resist the temptation of money and fame? Either he’s suicided or only an agency can hold up that “money” for nothing.

Another evidence is that the intel agencies haven’t destroyed crypto assets despite knowing that they enabled illegal activities (transnational-transfers, laundering, drugs, hitmen services, etc.) and the spy services paid by other countries, even enemy ones.

In fact, US agencies are using crypto for such illegal and spy activities themselves! So if they find crypto-currencies useful and keep them alive, then it’s almost certain they were created and/or fostered by them.

Think about the dark web or tax havens: they exist because the powers-that-be find them more useful than harmful for their nefarious secret goals.

“NakamotoSAtoshi is NSA.” It’s logical to assume that the NSA owns the genesis wallet.

NSA owns many other wallets.

NSA uses many wallets to transfer money for their shady businesses.

NSA agent made a mistake and sent money to the genesis wallet instead of others in the CIA list of wallets.

- Apart from sin-empowered demons, what is their main source of power? NOT a coincidence that the USA left dollar convertibility to gold in 1971, precisely triggering the exponential government deficit coupled with the trade deficit and inflation.

Taking down central banking doesn't solve the problem. Their source of free endless money is counterfeiting, fractional reserve banking and financial instruments (e.g. derivatives, debt over debt, compound interest above real growth, etc.). Also, insider information, sabotage, infiltration, manufactured news and events to create profitable market-movements.

This is the Achilles’ heel of all nations: the SSS (Satanic Secret Societies such as masonry) create trillions out of thin air and launder them through their Banks, foundations, and foreign loans and “aid”, with which they buy puppeticians and seats in the boards of the Federal Reserve (the only private-run Central Bank in the world), judiciary, corporations, media, healthcare, universities, foundations, political parties, etc.

The masons’ worst nightmare is that the daydreaming majority wakes up, finds out their crimes, and seek justice. We are a million to one. Until they achieve the CBDC digi-tatorship, they are walking on a tight rope.

We've got a very small window of opportunity to fight or ... die (they want to murder 95% of us).

President John Quincy Adams: “Masonry ought forever to be abolished. It is wrong - essentially wrong - a seed of evil, which can never produce any good.”

Who are The Powers That SHOULDN'T Be ?

https://scientificprogress.substack.com/p/criminal-intent

https://www.coreysdigs.com/global/who-is-they/

Weaponization of Justice

https://scientificprogress.substack.com/p/weaponization-of-justice

Illuminati David Rockefeller, finest quotes:

https://scientificprogress.substack.com/p/david-rockefeller-illuminati

Confessions of ex illuminati Ronald Bernard:

https://scientificprogress.substack.com/p/confessions-of-illuminati-ronald

Illuminati Attali, finest quotes:

https://scientificprogress.substack.com/p/attali-illuminati-finest-quotes

Chisholm, father of the WHO’s global pedophilia

https://scientificprogress.substack.com/p/brock-chisholm-father-of-the-whos

Ex mason Serge Abad-Gallardo:

https://www.ncregister.com/interview/confessions-of-a-former-freemason-officer-converted-to-catholicism

16 laws we need to exit Prison Planet

https://scientificprogress.substack.com/p/laws-to-exit-planet-prison

Please share, not the articles, but the information! I'm expendable. Saving the free world, is not!

Dogone it Scipio, that was a brilliant piece of writing!

Do I wish I had purchased five thousand bucks worth of Bitcoin when it was 23 cents? Darn straight! Am I going to go out and purchase it now at $100,000? Not on your life!

I'm not exactly a smart guy but I'm not a dummy either. When I have "computer techies" try and explain code-mining and digital currencies and such to me, I'm not quite sure that most of them fully understand it. Every explanation seems to be different than the one before it.